Guiding riders, families, and professionals toward lasting financial security.

Build a Legacy That Lives Beyond You

Elite Legacy Blueprint with High Impact Life Insurance Asset

Why Most Estate Plans Fall Short

Most families lose 30 – 40% of generational wealth due to taxes and probate.

A structured life insurance plan can help you:

✅ Enable tax-free legacy transfer

✅ Access liquidity during life

✅ Avoid probate delays

✅ Gain creditor protection

🏦 $68B+ lost annually to probate and legal fees

📉 70% of wealth is lost by the second generation

🔒 95% of the ultra-wealthy use insurance in legacy planning

Who This Strategy Is For

Tailored for high-earning professionals

and families who value control, tax efficiency, and generational impact.

👨⚕️ Physicians & Professionals

🏢 Business Owners

🧓 Retirees

🏘️ Real Estate Investors

Not Just Insurance

- A Strategic Wealth Asset

Traditional Insurance

- Pays out at death only

- No liquidity access

- Taxable exposure

- Mandated Required Minimum Distributions (RMDs) from age 73+

Strategic Wealth Asset

+ Grows tax-deferred

+ Withdraw tax-free

+ Immediate family liquidity

+ No Required Minimum Distributions (RMDs)

+ Transfer a Tax-Exempt Legacy to Your Beneficiaries

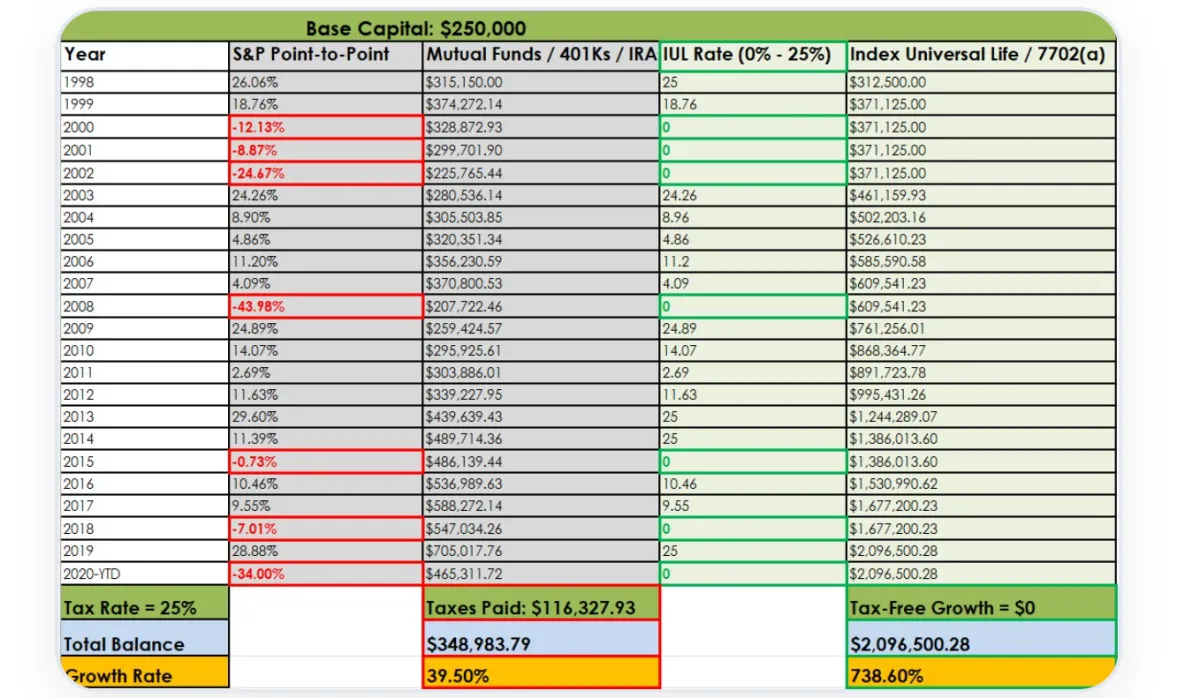

Visual Proof:

Indexed Strategies vs. Market Volatility

Compare the consistency and downside protection of an IUL strategy versus the unpredictable swings of traditional retirement plans.

4-Step Planning Process

Discovery: Define goals and vision

Design: Craft a custom solution

Deploy: Fund efficiently

Distribute: Transfer with confidence

What Clients are Saying

FAQ's

What is cash value life insurance?

A permanent life insurance policy that builds savings tax-deferred while providing a death benefit.

Can I use the funds while I'm alive?

Yes, through tax-free loans and withdrawals, for retirement or emergency use.

Will it bypass probate

Yes. Insurance proceeds go directly to the named beneficiaries - fast and tax-efficient.